Deseret First Credit Union: Discover The Member-Owned Difference Today

Are you searching for a financial partner that truly puts your interests first, perhaps one that offers a genuine sense of community? Many people, when they think about where to keep their money or get a loan, often wonder if their financial institution really has their back. It's a fair question, too. Deseret First Credit Union wants to show you just what a difference that kind of focus can make, you know, in your daily financial life.

This credit union, Deseret First, has a long and steady history, actually. They began offering financial services way back in 1955. For decades, they've been serving their community with a commitment to their members. This isn't just any local financial place, though. It's a federally chartered credit union, which means it operates under national guidelines, and it's also federally insured, which is very important. That insurance provides you, the member, a solid feeling of security for your deposits, giving you peace of mind, basically.

So, if you are curious about a financial institution that prioritizes its members and aims to make your financial dealings simpler, then Deseret First Credit Union is certainly worth a closer look. They invite you to experience this different approach firsthand, whether you visit their website or stop by a nearby DFCU branch location today. It's really about finding a place where your financial goals are understood and supported, and that's what they aim to do, you know.

- Despacito Lyrics English Song

- Thank You In Spanish

- Descargar Video De Instagram

- Red God Release Date

- Inside Out 2 Always On Phone

Table of Contents

- A Long-Standing Commitment to Members

- The Power of Member Ownership

- Finding Your Way: Branches, ATMs, and Shared Access

- Banking Made Simple: Your Everyday Financial Solutions

- Your Finances at Your Fingertips: Digital Convenience

- More Than Just Banking: Member Benefits and Support

- Compare and Save: Competitive Rates for You

- Getting Your Questions Answered and Connecting with DFCU

- Frequently Asked Questions About Deseret First Credit Union

A Long-Standing Commitment to Members

Deseret First Credit Union, you know, has been a trusted financial institution for a good while now. Established in 1955, it carries a history of service and dedication. Being federally chartered means it operates under a set of national standards, which provides a framework for its operations. Furthermore, it's federally insured, which is a key point for anyone considering where to place their savings. This insurance helps keep your money safe, giving you a quiet confidence about your funds, which is pretty reassuring, honestly.

Over the years, Deseret First has grown to be one of the largest credit unions in Utah, a testament to its enduring presence and its ability to meet the financial needs of its community. This growth suggests a consistent focus on what matters most to people seeking financial support and guidance. They aim to make finances easy for their members, offering a variety of services designed to simplify money management, actually. This long history means they have seen many changes in the financial world, yet they continue to provide stable and reliable service, which is quite something.

The Power of Member Ownership

One of the truly distinctive aspects of Deseret First Credit Union is its ownership structure, so it's almost a different kind of financial experience. When you become a member of this credit union, you also become an owner. This is a big deal, really, because it changes how the institution operates. Unlike banks that have stockholders, credit unions like Deseret First are owned by the very people who use their services, which is you, the member.

- How To Fake Sick

- Stanley Hudson From The Office

- What Does 67 Mean In Slang

- How To Remove Gel Polish

- La La Land Cafe

Because members own the credit union, and not outside stockholders, the financial benefits tend to flow back to you. Dividends, for instance, are returned to you as a member, which can feel a lot better than profits going to distant investors. This structure means the credit union's primary goal isn't just making money for shareholders; it's about serving its member-owners. This focus often translates into better rates on savings, lower interest rates on loans, and perhaps fewer fees, which can certainly make a difference in your personal finances, you know.

This member-first philosophy shapes every decision made at DFCU. They believe in putting members first, which means whatever financial solution you might need, they are there to help. This ownership model fosters a strong sense of community and shared purpose, making it feel less like a faceless institution and more like a cooperative effort. It's a rather unique way of doing business, honestly, one that many people find quite appealing.

Finding Your Way: Branches, ATMs, and Shared Access

Local Branches Across Utah

When you need to speak with someone in person or handle a transaction, finding a convenient location is very important. Deseret First Credit Union understands this, and so they have made sure to have a good physical presence across Utah. You can find 13 branches and ATMs of Deseret First Credit Union spread throughout the state, serving many communities. This includes places like West Valley City, Salt Lake City, Orem, and Provo, among others, which covers a good portion of the state, you know.

Whether you are in Salt Lake City or perhaps further south in St. George, there is likely a DFCU branch nearby. Their comprehensive branch locator tool can help you find the closest one. This tool lets you see the address, phone number, type of branch, and even the distance from your current location. It’s a pretty helpful way to plan your visit, actually, ensuring you know exactly where to go and what to expect before you even leave your home.

For example, if you need to visit their Salt Lake City Utah branch today, you can easily look up its hours and contact details. This accessibility is a key part of their commitment to making banking easy and convenient for their members. They want to make sure you can reach them, whether it's for a quick question or a more involved financial discussion, so they offer many ways to connect, you see.

Extended Reach: Shared Branches and ATMs

Even with 13 dedicated branches, Deseret First Credit Union goes a step further to ensure you have access to your money wherever you might be, which is a rather thoughtful approach. They are part of a larger network of shared branches, meaning you can conduct many of your DFCU transactions at hundreds of other credit union locations, not just their own. This vastly expands your banking options, giving you flexibility when you are away from a direct DFCU branch, you know.

Beyond shared branches, you also have access to thousands of ATM locations. This extensive network means you are rarely far from a place where you can get cash or check your balance. So, whether you are traveling for work or just out and about in a different part of the state, you can typically find an ATM that works with your Deseret First account. This kind of broad access really helps make managing your money simpler, actually, no matter where you find yourself. It’s all about convenience, after all.

Banking Made Simple: Your Everyday Financial Solutions

Deseret First Credit Union aims to provide financial solutions that fit your life, making everyday banking as straightforward as possible. They understand that everyone has different needs, so they offer a variety of products and services designed to be flexible and helpful. This focus on practical solutions helps members manage their money with less stress, which is a good thing, you know.

Checking and Savings Accounts

When it comes to your daily money management, having the right accounts is very important. DFCU has multiple checking account options available, designed for nearly every situation you might encounter. Whether you need a simple account for everyday spending or something with more features, they can help you find the account that fits your specific needs. This variety means you are not forced into a one-size-fits-all solution, which is quite helpful, really.

For saving your money, Deseret First Credit Union also offers high savings rates. This means your money can grow more effectively over time, helping you reach your financial goals sooner. They want to help you make the most of your deposits, so they work to provide competitive rates. It’s a good way to ensure your hard-earned money is working hard for you, too, basically.

If you are thinking about ordering checks for the first time for your Deseret First account, you might need a little help. In that case, you'll want to talk to a member services representative. You can contact them through online banking, over the phone, or by visiting a branch, making it easy to get started with your new checks, you see.

Loans for Life's Big Moments

Life often brings big purchases, like a new car or a home, and sometimes you just need a little help to make those dreams happen. Deseret First Credit Union offers various loan options to support these important moments. If you are in the market for a car, a house, or even a new credit card, you are probably hoping to get the lowest rate possible and borrow the most you can, and DFCU aims to assist with that, you know.

They compare the best credit union rates in Utah for various accounts and loans, including auto loans, credit cards, and mortgages. Their goal is to provide low loan interest rates and special offers for both members and businesses. This means you have a good chance of finding a loan that works for your budget and helps you achieve your goals without unnecessary financial strain. It’s all part of their commitment to putting members first, actually.

If you already have another DFCU account, perhaps a checking or savings account you opened at a branch or online, or maybe a credit card or an active home or car loan, they can make applying for new loans even easier. They will automatically fill in part of your application for you, saving you time and effort. You can also sign in to view the status or complete next steps on your loan application online, which is very convenient, basically.

Credit Cards with Rewards

For your everyday spending, a credit card can be a helpful tool, especially one that offers benefits. Deseret First Credit Union provides Visa rewards, giving you something back for your purchases. These rewards can add up, offering a nice little bonus for using your card. It's a way for them to show appreciation for your loyalty, you know, and make your spending a bit more rewarding.

They want to help you find a credit card that fits your spending habits and provides value. By offering competitive rates and a rewards program, DFCU aims to make their credit cards an attractive option for their members. It’s another example of how they try to make your financial tools work better for you, which is pretty neat, honestly.

Your Finances at Your Fingertips: Digital Convenience

In today's fast-paced world, being able to manage your money from anywhere is very important. Deseret First Credit Union understands this, and so they offer robust digital tools to give you control over your accounts, even when you are not near a branch. This digital access makes managing your finances much simpler and quicker, which is a real benefit, you know.

Online Banking and Mobile App

With Deseret First Credit Union, you can use online banking and their mobile app to handle many of your financial tasks. You can access your accounts, transfer funds between them, make payments on bills, and even deposit checks, all from your phone or computer. This means you can take care of your banking anytime, anywhere, which is incredibly convenient, really. You must be a registered user to use these features, of course, but signing up is usually a straightforward process.

The mobile app allows you to manage loans, pay bills, and move money with ease. Whether you need to switch funds between your DFCU accounts or send money to accounts at other institutions, they have you covered. You can also pay a friend or pay a loan directly through the app. This comprehensive digital suite helps keep your financial life organized and accessible, which is a big help for busy people, too.

Viewing Your Investments Online

Managing your investments can sometimes feel like a separate task, but Deseret First Credit Union aims to integrate it into your overall financial picture. They like making finances easy, so they’ve made it possible for you to view your investment accounts from CUSO Financial Services, which are located at Deseret First Credit Union, directly through your online banking portal. This means you don't have to go to a separate website or log in to a different system just to check on your investments, which is very helpful, honestly.

Having all your financial information in one place gives you a clearer view of your complete financial situation. It simplifies tracking your progress and making informed decisions about your money. This integration is another way DFCU works to provide a comprehensive and user-friendly financial experience for its members, you know, making sure everything is connected for your convenience.

More Than Just Banking: Member Benefits and Support

Deseret First Credit Union believes in offering more than just basic banking services. They strive to provide a holistic financial experience that includes benefits, community involvement, and strong protection for their members. This approach shows their commitment to truly serving the people who trust them with their finances, which is quite admirable, really.

Loyalty Benefits and Visa Rewards

Being a member of Deseret First Credit Union comes with its own set of advantages. They offer loyalty benefits, which are designed to reward you for your continued relationship with the credit union. These benefits can add value to your membership, showing appreciation for your trust and business. Additionally, as mentioned earlier, their Visa cards come with rewards, giving you tangible benefits for your everyday spending, which is a nice perk, you know.

These perks are part of the "difference" that Deseret First wants you to experience. They are not just about transactions; they are about building a lasting relationship where your loyalty is recognized and rewarded. This approach helps create a more satisfying banking experience, one where you feel valued, basically.

A Commitment to Community: The Charitable Foundation

Beyond individual member benefits, Deseret First Credit Union also extends its care to the broader community through its charitable foundation. This foundation reflects the credit union's values and its desire to give back to the areas it serves. Supporting a charitable foundation means that a portion of the credit union's efforts go towards good causes, helping to make a positive impact where it's needed most. It’s a way for the credit union to contribute to the well-being of the community, which is rather commendable, honestly.

This community involvement is another aspect of the credit union difference. It shows that their focus isn't solely on financial services but also on being a responsible and supportive neighbor. Members can feel good knowing that their financial institution is also working to improve the local community, you know, making it a better place for everyone.

Keeping You Safe: Member Protection

Protecting your financial information and assets is a top priority for Deseret First Credit Union. They provide a member protection notice, which outlines the measures they take to keep your accounts secure. This transparency about their security practices helps build trust and gives you confidence that your money and personal details are in safe hands. It’s a very important part of any financial relationship, after all.

They also provide information on how to protect yourself from fraud and other financial risks. By keeping you informed and implementing strong security protocols, DFCU works to ensure a safe banking environment. This dedication to member protection is another way they uphold their commitment to putting members first, making your financial security a constant concern, you see.

Compare and Save: Competitive Rates for You

Finding good rates on savings and loans can make a real difference in your financial health, so Deseret First Credit Union makes it easy to compare. They want you to find high savings rates, which means your money can grow more quickly. At the same time, they offer low loan interest rates, helping you save money when you borrow for things like a car or a home. This balance of good rates for both saving and borrowing is a key benefit of being a member, you know.

They encourage you to compare their loan rates, financial services, and even member reviews with other institutions. This transparency shows their confidence in the value they provide. They also have special offers for members and businesses, which can provide even more savings or benefits. It's about ensuring you get the most value for your money, whether you are saving it, borrowing it, or just managing it, which is quite important, really.

Getting Your Questions Answered and Connecting with DFCU

Having easy access to help and information is a big part of a positive banking experience. Deseret First Credit Union makes it simple to get your questions answered and to connect with them in a way that suits you. They want to be there for you whenever you need assistance, which is a rather comforting thought, honestly.

You can find answers to common questions about DFCU's products, services, membership, and locations. They have resources that explain how to access online banking, order checks, apply for loans, redeem rewards, and more. This comprehensive support helps you

- Valentino Born In Roma

- Cast Of Kpop Demon Hunters

- What Is The Healthiest Energy Drink

- Cuantas Calorias Tiene Una Manzana

- Jojo Siwa Magazine Cover

Deseret First Credit Union Discount Card

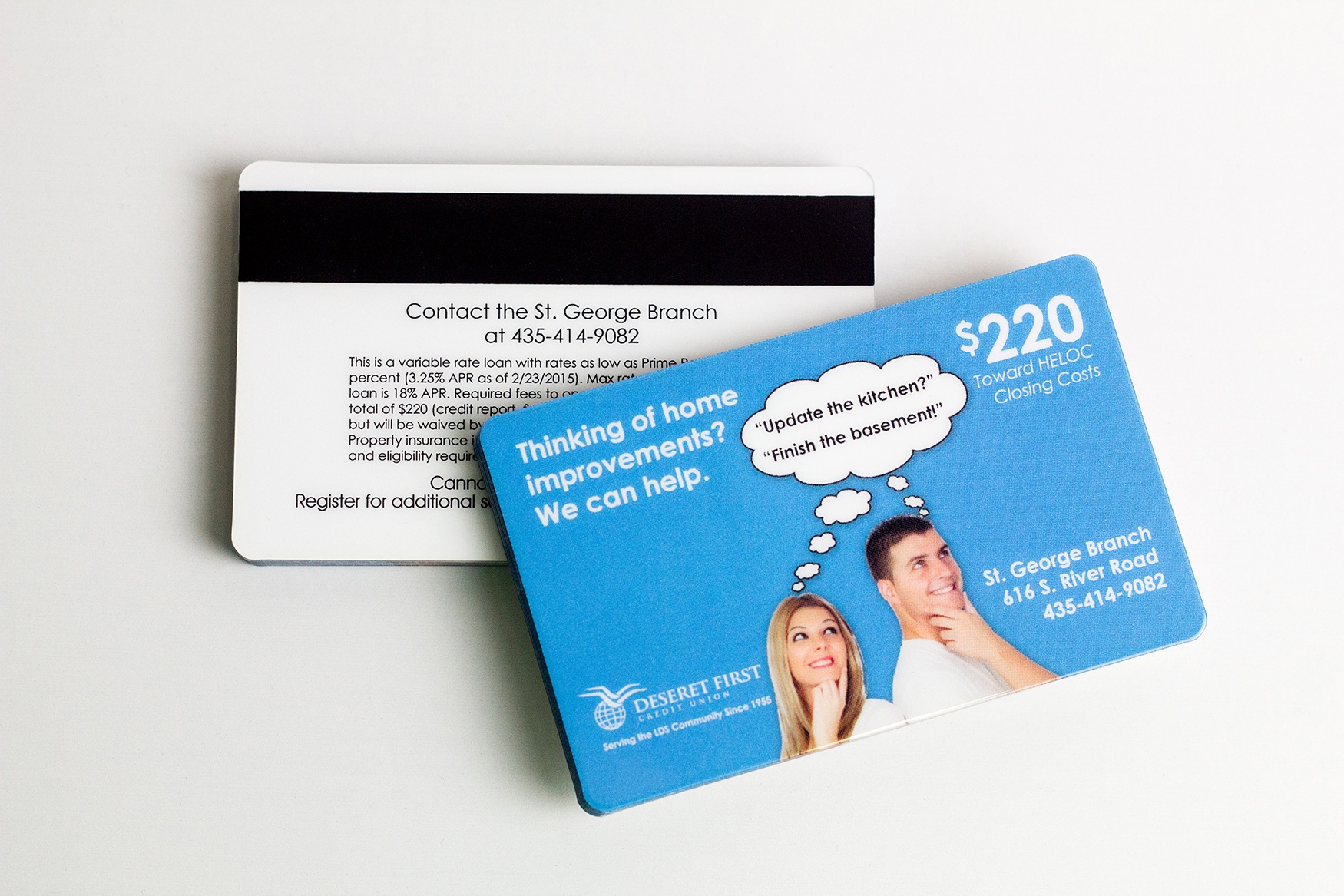

DESERET FIRST CREDIT UNION - St. George UT - Hours, Directions, Reviews

Happy Independence Day from... - Deseret First Credit Union